2024 Unreimbursed Business Expenses Format

1 min read2024 Unreimbursed Business Expenses Format – Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations. Whether you’re an entrepreneur or a small business . This capital can be used for many business needs, including expenses that can’t be covered by a credit card like payroll, inventory and vendor bills. You’ll also only pay interest on what you .

2024 Unreimbursed Business Expenses Format

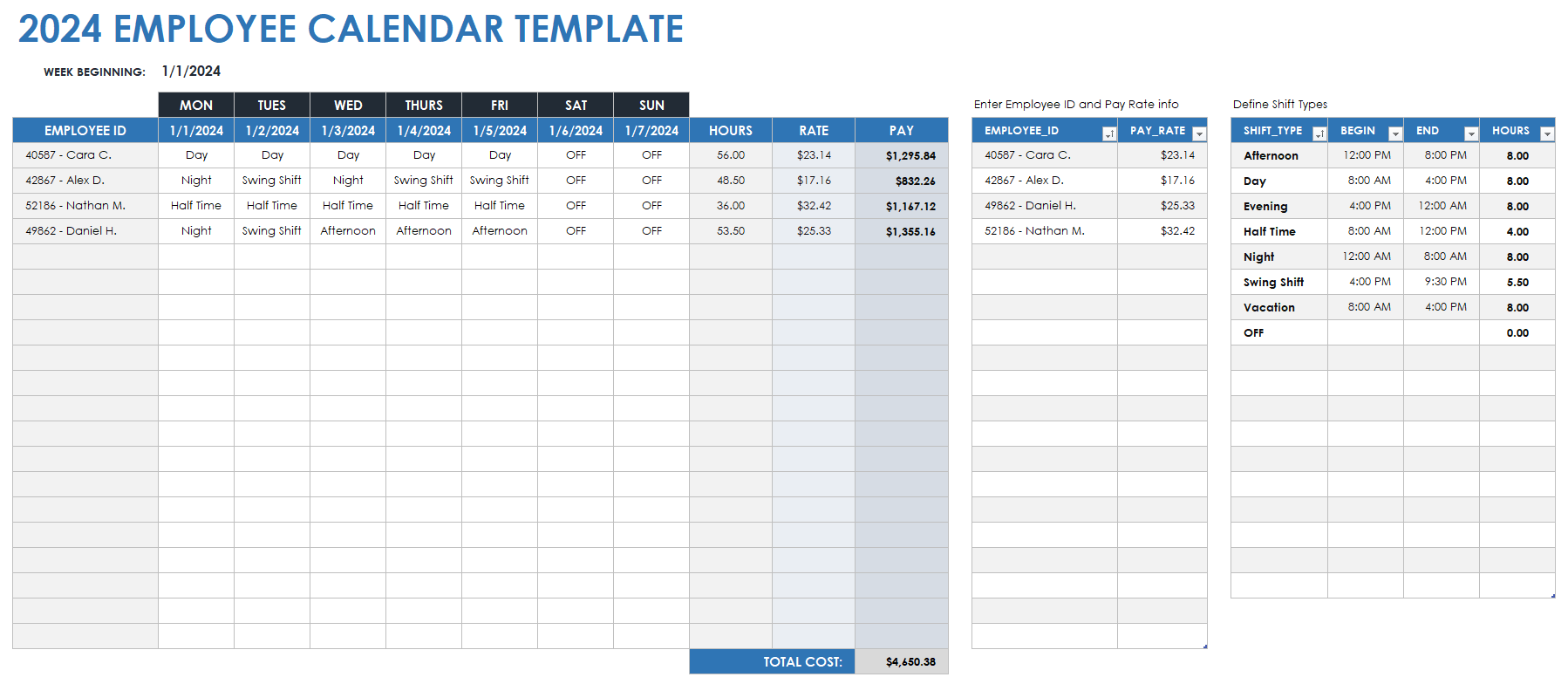

Source : www.investopedia.comFree Google Calendar Templates | Smartsheet

Source : www.smartsheet.com10+ Expense Report Templates You Can Edit Easily Venngage

Source : venngage.comForm expenses template: Fill out & sign online | DocHub

Source : www.dochub.comExpense Report Templates for Efficient Expense Tracking | Creately

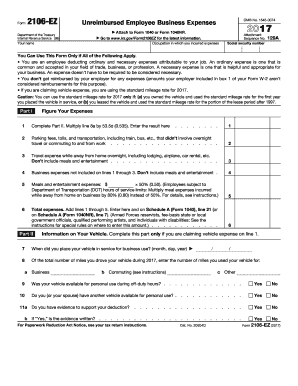

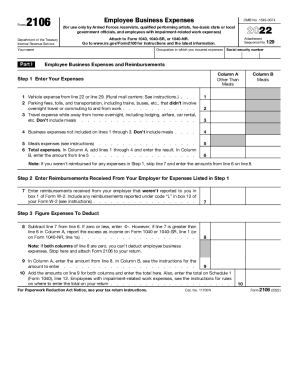

Source : creately.comIRS 2106 EZ 2017 2024 Fill out Tax Template Online

Source : www.uslegalforms.com10 Free Expense Report Templates for Effortless Budgeting | ClickUp

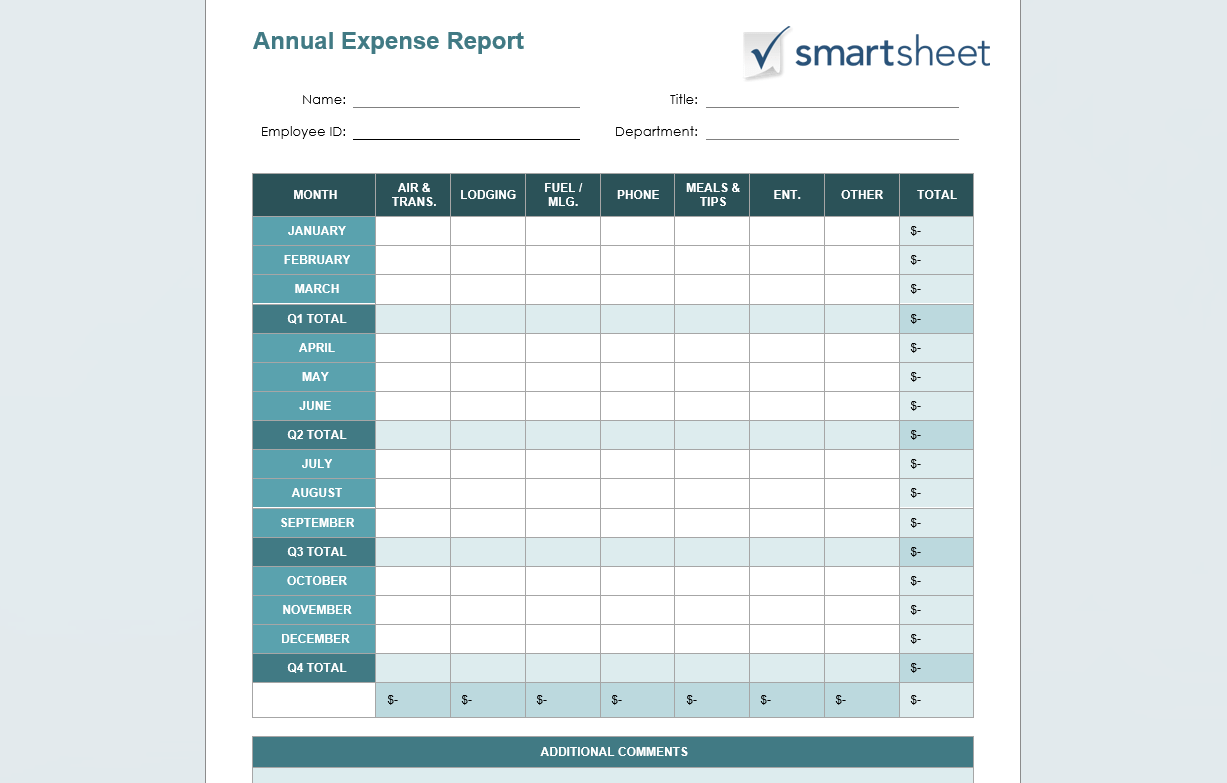

Source : clickup.comIRS 2106 2022 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.comFree Leave Tracker Excel [2024] Vacation Tracker

Source : vacationtracker.io10+ Expense Report Templates You Can Edit Easily Venngage

Source : venngage.com2024 Unreimbursed Business Expenses Format Form 2106: Employee Business Expenses: Definition and Who Can File: According to the IRS you can write off: Gambling losses Teachers can deduct up to $300 of any unreimbursed business expenses for classroom materials, such as books, supplies, computer etc. . Valicia is an accomplished author and a Junior Copywriter at Uncanny Content. She believes that words can help create a better world, which is why she helps impact-driven businesses increase their .

]]>:max_bytes(150000):strip_icc()/Screenshot2024-01-12at4.04.42PM-6ae67168a2a848849de8750450dab1af.png)